Dumb Money

Posted on September 14, 2023 at 5:15 pm

B +| Lowest Recommended Age: | Mature High Schooler |

| MPAA Rating: | Rated R for pervasive language, sexual material, and drug use |

| Profanity: | Constant very strong and crude language |

| Alcohol/ Drugs: | Alcohol and brief drug use |

| Violence/ Scariness: | None |

| Diversity Issues: | None |

| Date Released to Theaters: | September 15, 2023 |

| Date Released to DVD: | November 13, 2023 |

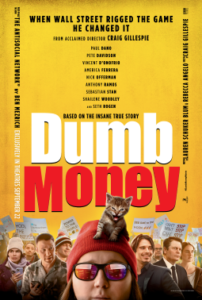

First there was the documentary, Eat the Rich: the GameStop Saga. And now, the feature film, “Dumb Money,” with an all-star cast, a smart screenplay by Lauren Schuker Blum and Rebecca Angelo, and lively direction from Craig Gillespie. The movie does a good job of conveying the intricate details of investing and finance in the context of a movie that maintains a heightened tone through sharply executed editing, provocative needle-drops on the soundtrack (beginning with WAP), and minimal exposition.

In very sharp contrast to the music on the soundtrack, Paul Dano plays the central figure, mild-mannered Keith Gill, who lives with his wife, Caroline (Shailene Woodley), and their baby daughter in a modest home in Brockton, Massachusetts. Like a movie superhero, he has a secret identity. By day he was a financial analyst with MassMutual. By night he had not one but two personas, one on the subreddit r/wallstreetbets (DeepF***ingValue) and one on YouTube (Roaring Kitty). In both, he talked about stocks he liked and he revealed his own trades. In January 2021, he announced that he had invested in 50,000 shares and 500 call options for GameStop, the store that sells video games in malls. Most investors, including Wall Street billionaires, thought GameStop was going to go bankrupt. The US was still in pre-vaccine pandemic lockdown, though GameStop somehow got listed as an essential business because it sold some computer peripherals, so the stores were still open. But Keith explained his reasons for thinking the stock, trading at under $4 a share, was undervalued.

The Wall Street billionaires also put their money where their mouths were and bet against the company by going “short,” meaning they would make money if the stock went down. Normally, they would have succeeded. But nothing in this story was normal. It was a perfect storm. First, the pandemic shut everything down and made people feel even more mistrustful of big institutions than they were before. This was especially true of the people of Keith’s generation, who were in school on 9/11 and were entering the job market just as the financial meltdown hit the economy with no consequences for the people who caused it. Second, social media made it possible for anyone, like Keith for example, to express views on platforms that were as accessible as traditional media. And it made it possible for followers to support each other and bring in more. Gill went viral. Third, thanks to a new app with no fees, buying and selling stock and even complicated securities like puts and calls (options) was suddenly as easy as sending a text. And fourth, people were stuck at home. They felt stuck in an unfair world. They did not have access to complex investment securities analysis about big, complicated corporations. But they could understand Roaring Kitty, and they could understand GameStop.

And then, Roaring Kitty. People followed his recommendations because he showed them that he was using his own money, because he was an outsider and therefore more like them, because that trading app on their phones was called Robin Hood and trades were “free,” and, this is the key point, after a while, when it was clear that they were costing the Wall Street short sellers billions as their purchases made the stock go up, they were just as happy to be beating the mega-wealthy as they were to be making thousands, tens of thousands, and in Keith’s case, millions for themselves. The trading app was named Robin Hood, which sounded anti-Wall Street. These new investors came up with a new meme-able term: “stonks,” meaning “we’re doing it our own way and it is more about the fun than about making money.” Their loss is almost entirely limited to their modest investments while the short sellers risk losses one television commentator (in real-life archival footage) calls “infinity.”

Gillespe has a sure hand with a chaotic story, giving us just enough information to follow what is happening without weighing us down with the details of finance. Schuker Blum and Angelo have a sharp sense for telling detail. One of the investors is a GameStop employee (Anthony Ramos) with a bureaucratic boss. We get a glimpse of the gulf between the MBAs at headquarters sending out lists about which products have the highest profit margins (“push the loyalty card!”) and the reality of the tiny shop in the otherwise-empty mall. Other investors include a nurse and single mother (America Ferrara) and a pair of debt-ridden college students played by Talia Ryder and Myha’la. Sebastian Stan appears as Robin Hood co-founder Vladimir Tenev. He claims that they were inspired by Occupy Wall Street and his coyness about how they make money when they do not charge a transaction fee turns out to be very significant when Robin Hood’s connection to another player in this story comes out.

There’s an “Empire Strikes Back” element when the people with billions at risk start playing hardball. But Gill understands that Wall Street is overlooking the app investors the way they look the customers of GameStop and his followers, dazzled by their gains and thrilled by schadenfreude. If they had not felt that they were being treated like losers for so long, the win would not mean as much.

The superb cast includes Clancy Brown and Kate Burton as Keith’s parents and Pete Davidson as his slacker brother, whose job in the movie is to contrast and target for exposition. Nick Offerman is excellent as billionaire Ken Griffin and Seth Rogen is in top form as Gabe Plotkin, the guy whose highly leveraged bet against GameStop turns out to be a monumental mistake. In the beginning of the film, his casual entitlement in talking to a contractor who is supposed to be tearing down a house so Plotkin can have a tennis court is in sharp contrast to his unraveling as things go south. You can see the real Plotkin’s testimony here. (Don’t feel sorry for him. He’s now an owner of the Hornets.) There are a dozen clever details that give the story texture, from the recreation of the stonk memes to the coaching for the zoom testimony to a Congressional committee. (You can see Gill’s testimony here.)

It’s entertaining and thought-provoking. With any luck, it will inspire other Gills to find what the experts overlook, which is, after all, how capitalism works.

Parents should know that this film has non-stop strong and vulgar language, spoken by the characters and on the soundtrack, including the n-word. Characters drink alcohol and briefly smoke marijuana and there is a bawdy, sexualized game at a college party.

Family discussion: Who would you trust to give you investment advice? Why did so many people trust Keith?

If you like this, try: the “Eat the Rich” documentary, the book by Ben Mezrich, and “The Big Short” (Note a brief appearance by the real-life character played by Leonardo DiCaprio in “The Wolf of Wall Street,” Jordan Belfort)